Vanessa Rader

Head of Research

Ray White Group

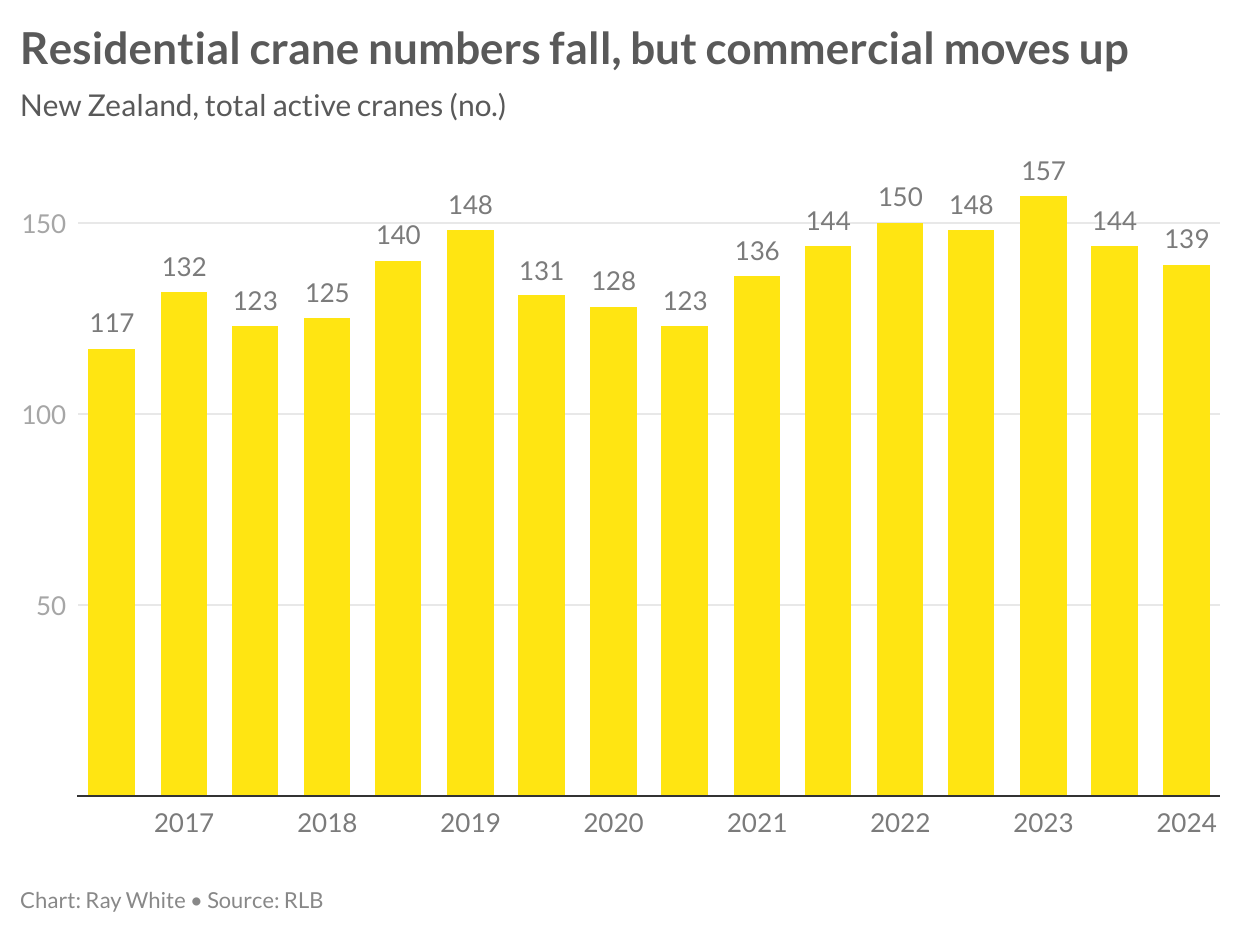

Results from Rider Levett Bucknall’s Crane Index for the first quarter of 2024 highlight a continued reduction in cranes on the New Zealand skyline to a three year low. There were just 139 cranes adorning the cities, 30 of which for residential development, down from 76 cranes 18 months ago. The completion of various projects and a limited pipeline of new supply (as residential building consents have fallen 16.5 per cent in the 2023 calendar year) are a likely indicator for the year ahead. Sentiment surrounding interest rates has dampened business confidence and the ongoing lack of labour is a key constraint for the construction sector. Encouragingly, however, has been the uptick in activity across non-residential market segments including recreation, health, and education facilities as well as traditional commercial (office) development.

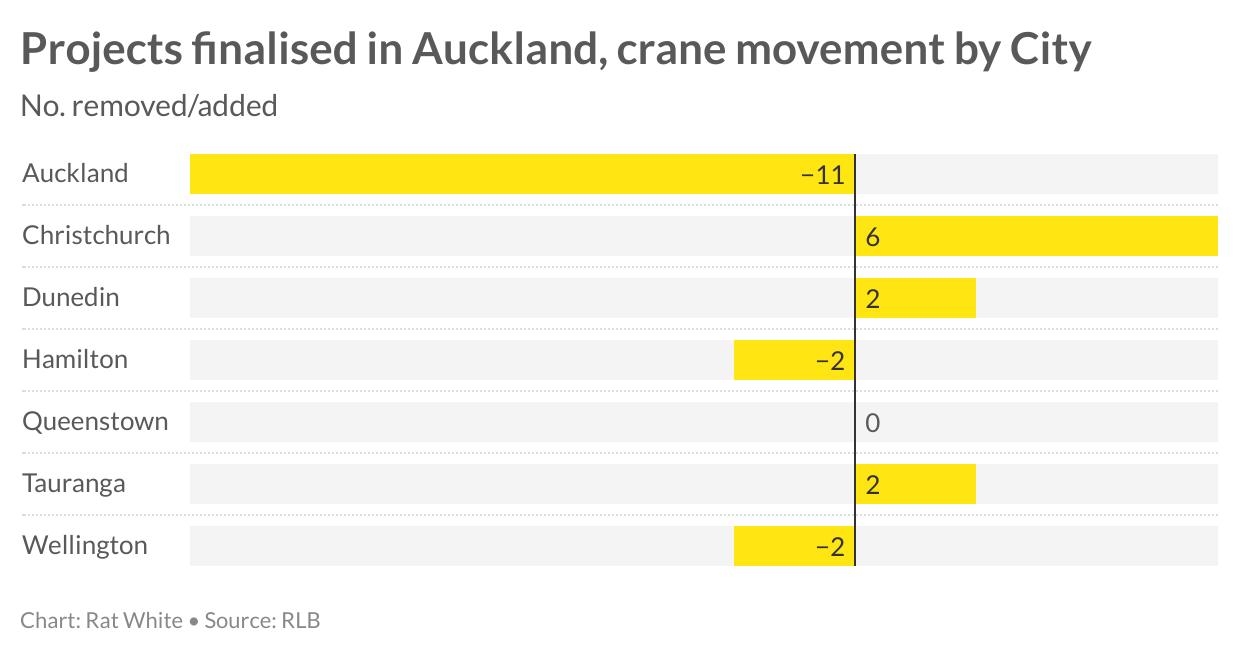

Auckland continues to be the most active construction market. Over the last six months, 36 cranes were removed with another 25 placed resulting in a net loss of 11, again dominated by the residential sector. The proportion of residential cranes fell from 57 per cent of all long-term cranes in Q3 2022 to just 26.6 per cent in Q1 2024 and without significant commencements expected over the next six months. This level will remain subdued over the short term. Across Auckland there have been some segments which have seen net increases in cranes, including commercial, data centres, education, health and retail.

Christchurch has seen the greatest net gain in cranes this period, now representing 24 cranes. However, this is due to the ten cranes on site at the Te Kaha Christchurch Stadium putting upward pressure on the recreation category, while residential sits at just two cranes, the same as the civic, civil, education and health categories. In the nation’s capital, Wellington, only 10 long term cranes sit on projects, down from 12 six months ago. These are dominated by non-residential sectors of commercial, recreation, education and health with only one residential project requiring a crane.

Smaller markets such as Dunedin have seen an increase in activity, now with seven long term cranes, dominated by the New Dunedin Hospital’s inpatient and outpatient building projects. Tauranga is another growth market, now up to six cranes, all of which are for non-residential projects, with increases coming from the commercial and civic sectors. Conversely, Hamilton has halved its crane count, down to two civic projects, after the removal of cranes at the Union Square project and Awatere Retirement Village.

Queenstown has seen no net change, with six cranes removed and six erected, totalling 11 cranes, with residential being the feature of activity in the region representing 54.5 per cent. Commercial projects also are prominent including the Skyline, 9 Brunswick Street, Central Street and 1094 Frankston Road projects. With building consents for residential developments down across all markets, the outlook will remain subdued for this segment of the market for the remainder of 2024.

DOWNLOAD IMAGES

Media contacts:

Vanessa Rader

Head of Research

Ray White Group

+61 432 652 115

vrader@raywhite.com

Cassandra Glover

Media Advisor

Ray White Group

+61 447 000 472

cglover@raywhite.com