Nerida Conisbee

Ray White Group

Chief Economist

New Zealand may no longer be in recession but economic conditions remain challenging. The unemployment rate picked up to 4.6 per cent in the June quarter, the highest level since the start of 2021. Home consents are down 24 per cent over the past 12 months and consumer spending shows that the cost of living is tightening household budgets.

It is therefore good news that the RBNZ finally cut rates this month, despite the June quarter inflation rate being marginally above the target range of between 1 and 3 per cent. Inflation hit 3.3 per cent in the June quarter but as it is only measured quarterly, it is highly likely that by the end of July, it moved below 3 per cent. This was likely one of the deciding factors for the RBNZ.

The rate cut is welcome news for mortgage holders and is likely to lead to house price growth across the country. House prices declined slightly over the June quarter by 1.9 per cent, with Auckland and Wellington recording the largest declines of 2.7 per cent. A key driver of the decline are high stock levels. New Zealand is currently a buyers market but buyers are likely to be running out of time to secure homes at these lower prices with the announcement today.

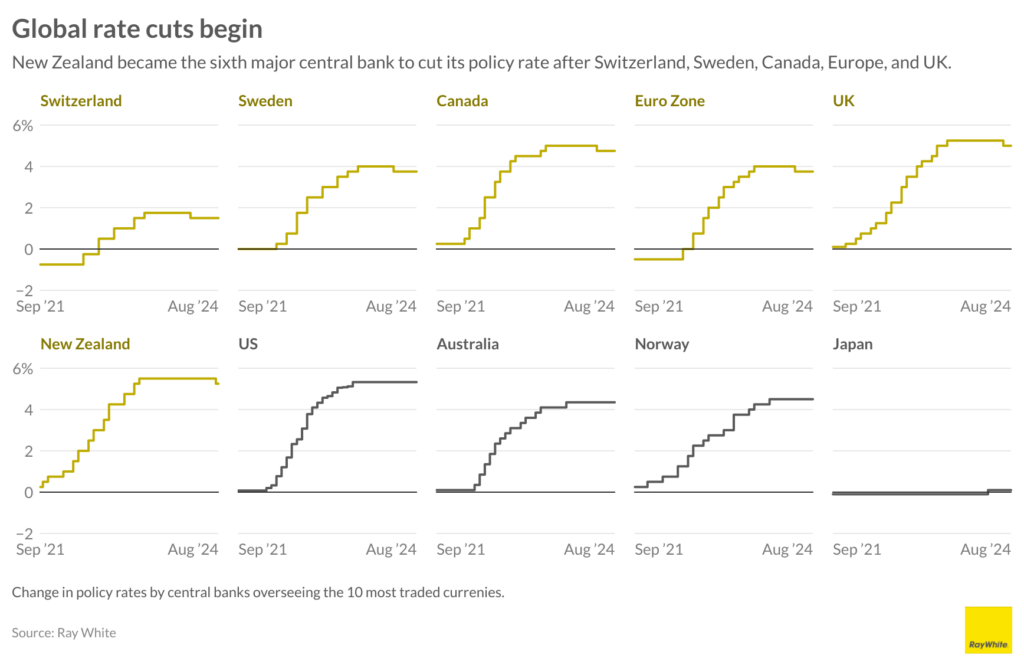

Globally, New Zealand is in good company in cutting rates. The Bank of England cut rates two weeks ago. The US is set to move next month, with the jobless rate in that country recently hitting its highest level in three years. These countries join Switzerland, Sweden, the European Union and Canada which were the first to move. Australia’s inflation rate ticked up marginally in the June quarter however timing for rate cuts has been brought forward to early next year.

Media contacts:

Nerida Conisbee

Ray White Group

Chief economist

nconisbee@raywhite.com

+61 439 395 102

Cassandra Glover

Senior Media Advisor

Ray White Group

+61 447 000 472

cglover@raywhite.com