Odds are rising for rate cuts with May being the earliest RBNZ will cut

Nerida Conisbee

Chief Economist

Ray White Group

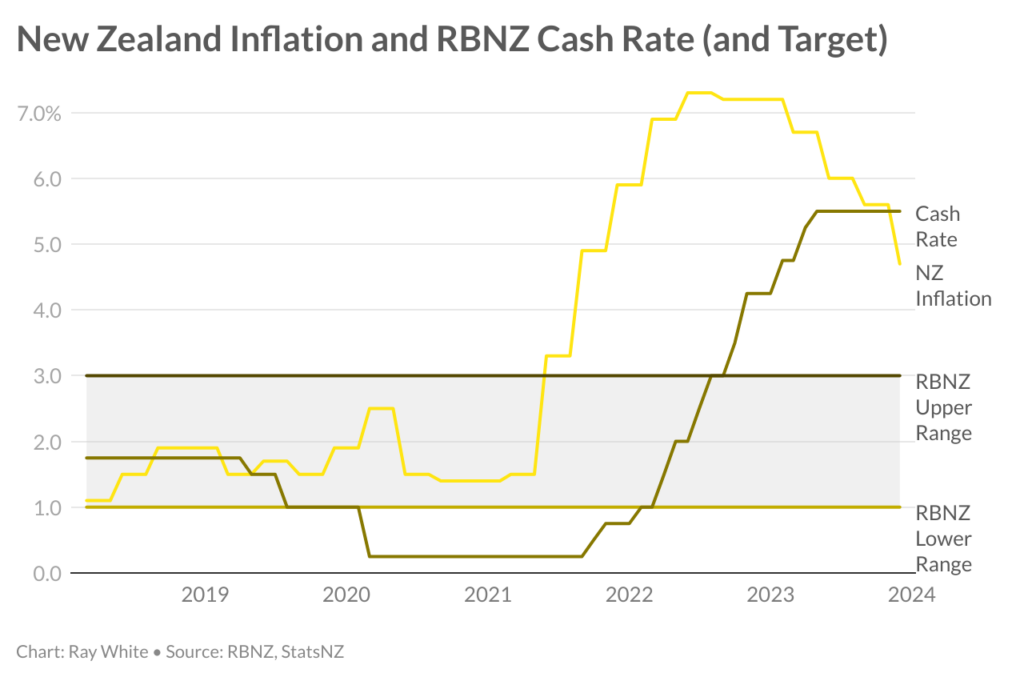

No surprises that rates were kept on hold today. There is no new news on inflation (latest data shows 4.7 per cent annually as at December) or on economic growth (at -0.1% for the December quarter). Until we at least have March inflation data, due on April 17th, it is likely that the RBNZ will hold off until the meeting following that announcement, scheduled for May 22nd.

Can we expect a cut in May? The answer is that nobody knows for sure. However, an inflation rate within the 1-3 per cent would give the RBNZ firmer ground to cut. It may even decide to cut at an inflation rate slightly higher than 3 per cent. With the economy moving dangerously into a potential recession, and the slow moving nature of monetary policy impacts, it would pay to move earlier than later. Right now, the RBNZ doesn’t expect inflation to be within its target range until at least September.

Globally, the situation is similar to New Zealand. Since the end of last year, the outlook for rates has moved quickly from the potential for more increases to the likelihood of 2024 cuts. In the US, the Federal Open Market Committee has predicted three cuts for this year. In Australia, the RBA Governor has said that they may cut rates even before they hit the 3 per cent upper target. The European Central Bank has hinted at cuts beginning in June. The UK, already in recession, is also expected to start cutting in June. While at this point a May cut may or may not happen, for most New Zealand mortgage holders, the cuts can’t come quick enough.

Download images of Nerida here.

Media contacts

Nerida Conisbee

Ray White Group

Chief Economist

nconisbee@raywhite.com

+61 439 395 102