Vanessa Rader

Head of Research

Ray White Group

The Reserve Bank of New Zealand (RBNZ) has maintained its Official Cash Rate at 5.50 per cent, signalling a pause in its monetary tightening cycle. This decision reflects the central bank’s careful balancing act between managing inflationary pressures and supporting economic growth amid global uncertainty.

By holding the rate steady, the RBNZ suggests the current level is sufficient to guide inflation towards its 1-3 per cent target range. However, this pause also indicates growing concerns about potential economic slowdown. The central bank is likely mindful of the risks associated with over tightening monetary policy, which could push the economy into recession.

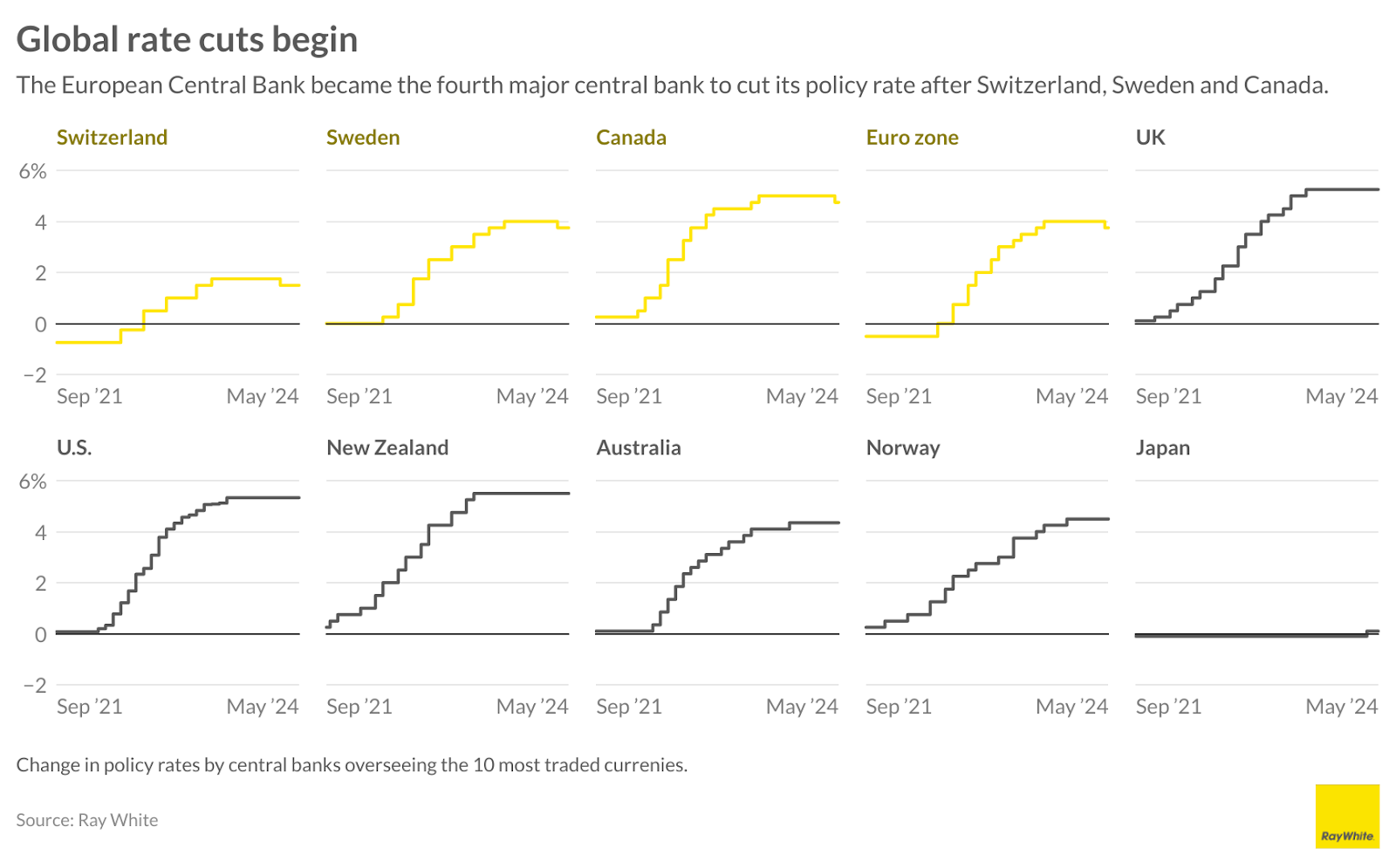

This aligns with international markets adopting a “higher for longer” policy, with limited changes expected this year and downward movements anticipated in 2025. However, many markets have already diverged from this trend. Switzerland cut rates in March, and Sweden became the first country in this cycle to cut interest rates following very high inflation. The landscape shifted further on June 5 when Canada cut interest rates, followed by the European Central Bank the next day, despite not reaching its target rate. European inflation currently stands at 2.4 percent, with the ECB target at 2 percent.

New Zealand’s housing market, a longstanding concern, has shown signs of cooling due to previous rate hikes. By maintaining the current rate, the RBNZ may be seeking to avoid a sharp downturn in the real estate sector, which could have broader implications for the overall economy and financial stability.

Looking ahead, the RBNZ will likely continue to closely monitor a range of economic indicators, including international markets, to determine if further rate adjustments are necessary. Key factors under scrutiny will include inflation data, employment figures, GDP growth, and business confidence.

DOWNLOAD IMAGES

Media contacts:

Vanessa Rader

Head of Research

Ray White Group

+61 432 652 115

vrader@raywhite.com

Cassandra Glover

Media Advisor

Ray White Group

+61 447 000 472

cglover@raywhite.com