Atom Go Tian

Senior Data Analyst

Ray White Group

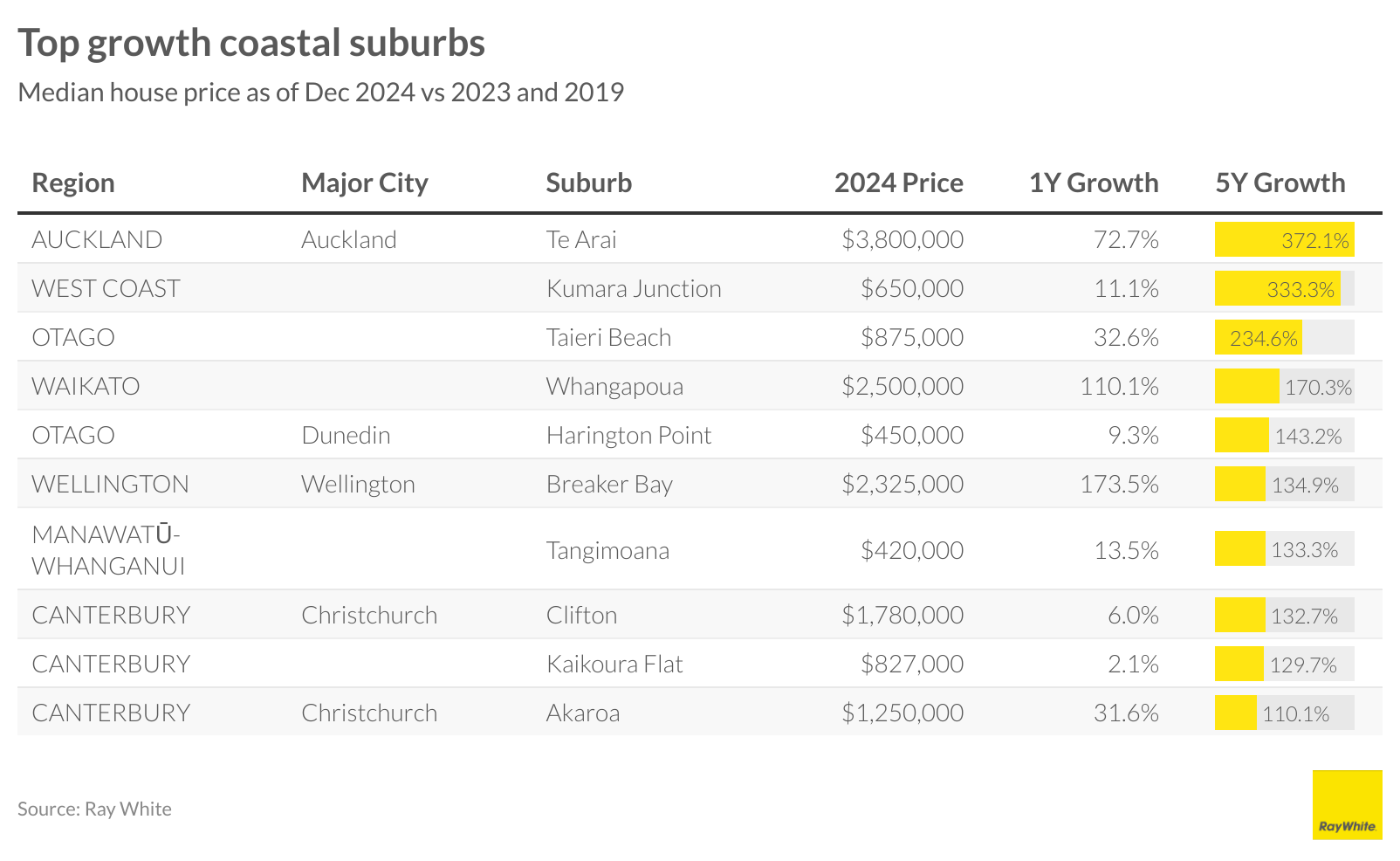

New Zealand’s top-performing coastal suburbs show a broad geographic distribution across both North and South Islands, with particularly strong representation from Otago and Canterbury. The scale of growth is substantial, ranging from 110 per cent five year growth in Canterbury’s Akaroa to an extraordinary 372 per cent growth in Auckland’s Te Arai.

The South Island commands a slight bias with six of the highest-growth coastal suburbs. In Otago, Taieri Beach has reached $875,000 (235 per cent five-year growth) while Harington Point stands at $450,000 (143 per cent). Canterbury’s market is led by Clifton (132 per cent), followed by Kaikoura Flat (129 per cent) and Akaroa (110 per cent). A notable outlier is Kumara Junction in the West Coast region, achieving the second-highest five-year growth rate of 333 per cent and a median house price of $650,000.

The North Island’s coastal market is dominated by Te Arai in Auckland, which leads both in median price ($3.8 million) and five-year growth (372 per cent). Whangapoua in the Waikato region has shown remarkable recent momentum, reaching $2.5 million with five-year growth of 170 per cent. The North Island’s highest-growth coastal suburbs are completed by Breaker Bay in Wellington (134 per cent) and Tangimoana in Manawatū-Whanganui (133 per cent).

Five of the top ten growth suburbs command values above $1 million, with Te Arai in Auckland leading as both the highest-growth region and the most expensive location, reaching a median house price of $3.8 million. Among these premium locations, Whangapoua in Waikato and Breaker Bay in Wellington command values above $2 million, while Clifton and Akaroa in Christchurch are valued at $1.78 million and $1.25 million respectively.

Recent growth patterns in the three most expensive areas have been particularly striking. Breaker Bay recorded the highest one-year growth at 173 per cent, followed by Whangapoua at 110 per cent, and Te Arai at 72 per cent. This suggests accelerating value appreciation in these premium coastal locations.

At the other end of the spectrum, areas like Tangimoana in Manawatū-Whanganui and Harington Point in Dunedin offer more accessible entry points at $420,000 and $450,000 respectively. Perhaps most surprisingly, the West Coast’s Kumara Junction emerges as a strong performer, with 333 per cent five-year growth despite a more modest current value of $650,000, demonstrating the potential for significant capital growth in less traditionally premium locations.

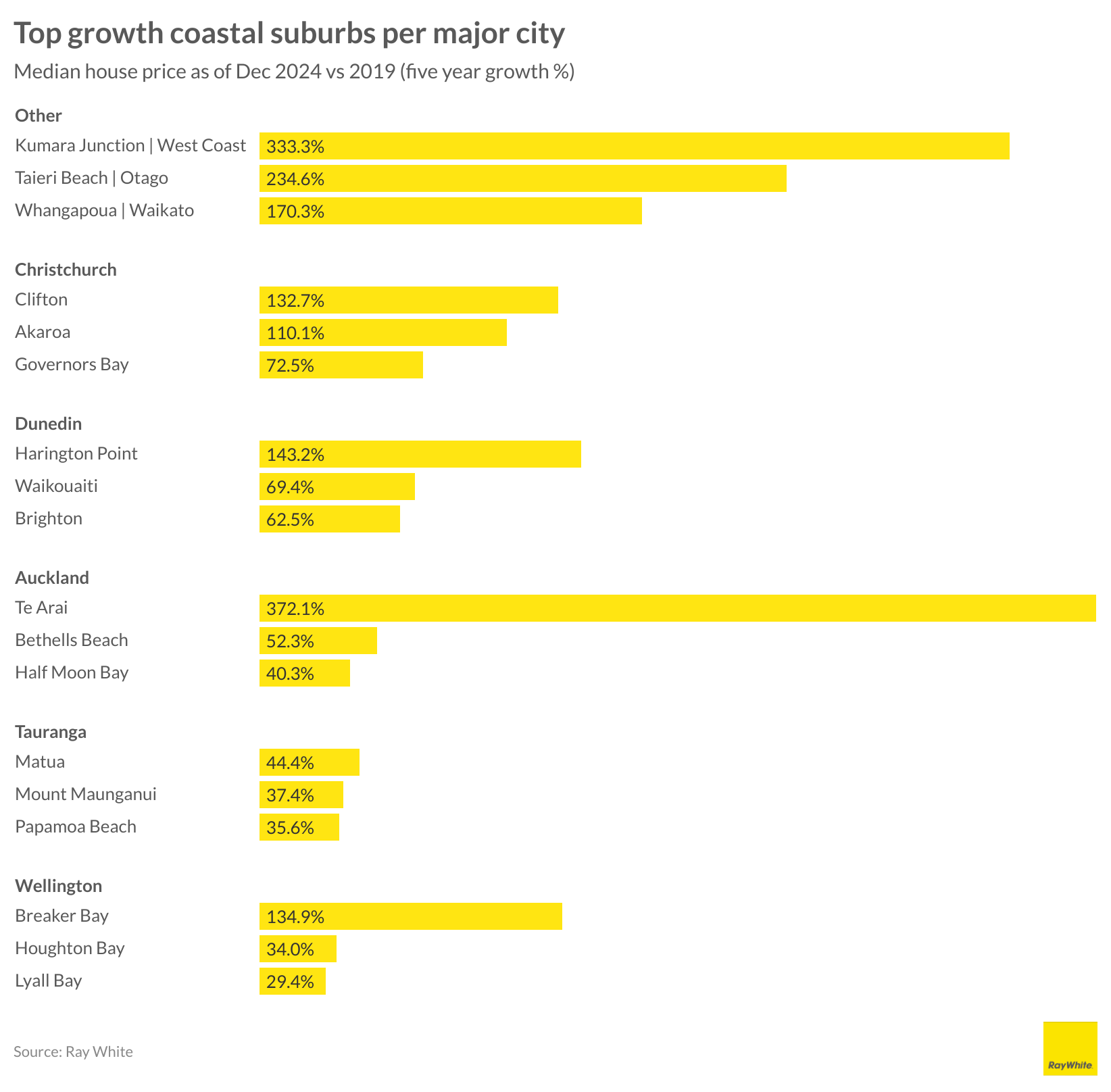

Analyzing the top three suburbs in each major coastal city reveals several interesting patterns.

First is the notable presence of high-growth outliers within each major city. Auckland’s Te Arai leads with remarkable five-year growth of 372 per cent, while Dunedin’s Harington Point and Wellington’s Breaker Bay show impressive gains of 143 per cent and 135 per cent respectively. As such, the variability in growth rates differs significantly among cities. Auckland exhibits the widest range, with growth rates spanning from 40 per cent to 372 per cent, followed by Wellington with a substantial spread from 29 per cent to 135 per cent. In contrast, Christchurch and Tauranga display more consistent growth patterns across their coastal suburbs.

When examining the market without these standout performers, Christchurch emerges as the leader in coastal growth. Its coastal suburbs show strong, consistent appreciation, with Clifton achieving 133 per cent growth, Akaroa 110 per cent, and Governors Bay 73 per cent. Dunedin follows this pattern of steady growth, with Waikouaiti and Brighton recording 69 per cent and 63 per cent growth respectively. Both Auckland and Wellington, despite their headline-grabbing top performers, show more modest growth in their secondary coastal locations.

Perhaps most significantly, smaller towns and regions categorized as “other” are outperforming major cities in five-year growth rates. This suggests a shift in coastal development patterns toward rural and smaller urban areas, potentially driven by changing lifestyle preferences and value considerations.

Download charts here

Media contacts:

Atom Go Tian

Ray White Group

Senior data analyst

agotian@raywhite.com

+61 422 089 938