Nerida Conisbee

Ray White Group

Chief Economist

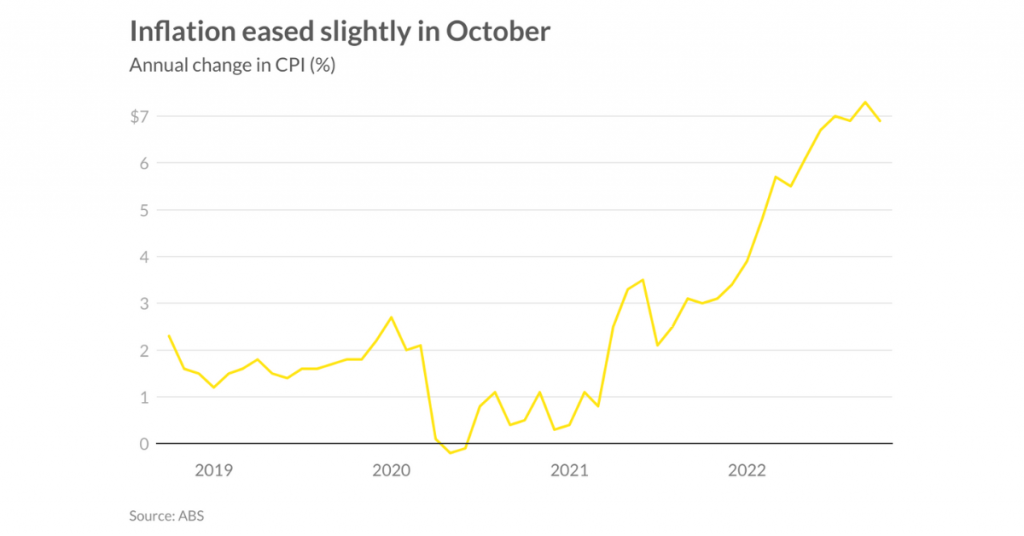

With inflation now starting to come back, it is looking like interest rate rises are coming to an end. In October, inflation came in at 6.9 percent over the previous 12 months. This is lower than the 7.3 percent recorded in September. Nevertheless, the Reserve Bank of Australia (RBA) has given it one more nudge as we head into Christmas, increasing the cash rate by 0.25 percent.

Does this mean the end is in sight for interest rate rises? It is still too early to tell. While inflation has come back a little bit, there are still challenges in the construction industry, flooding has impacted food costs, and very big increases in advertised rents are yet to flow through to inflation numbers. More positively, fuel costs have come back and supply chain blockages have eased. The market was pricing in a peak of 4.1 percent but that has now pulled back to 3.7 percent. An even lower inflation rate in November will pull this back even further.

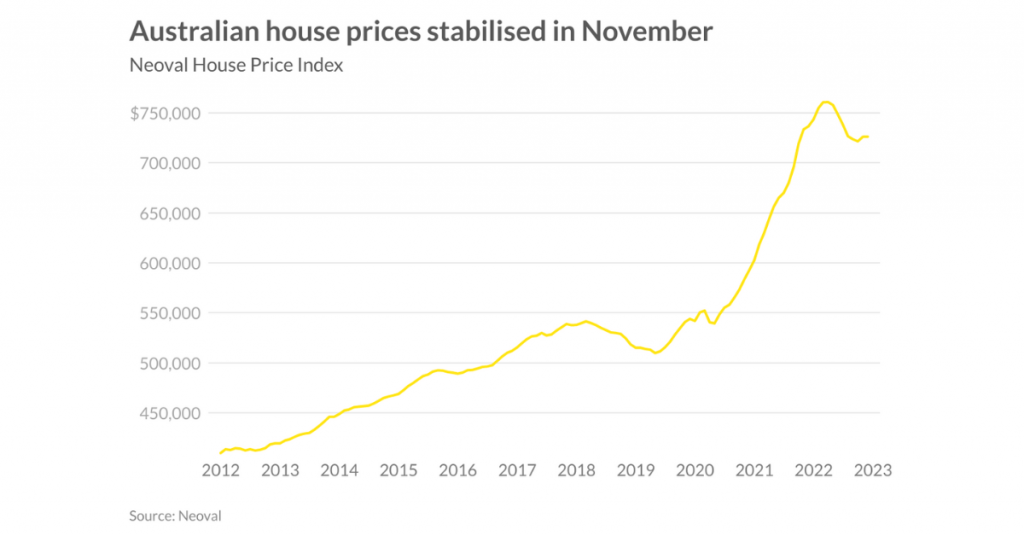

The more positive interest rate outlook has in part flowed through to house prices. According to Neoval, Australian house prices remained stable in November after having declined by 4.5 percent since March 2022. While interest rates have played a role in this, it is likely that other factors such as population growth and housing shortages have also contributed. The fall in house prices may continue but at this point, it is hard to imagine that we will get anywhere close to even a 10 percent decline in this cycle for Australia as a whole.

Note to eds: Neoval is the White family’s latest business start-up providing property data and analytics in Australia and New Zealand.